tokyo stocks surge as us and china ease trade tensions

Tokyo, Tuesday, 13 May 2025.

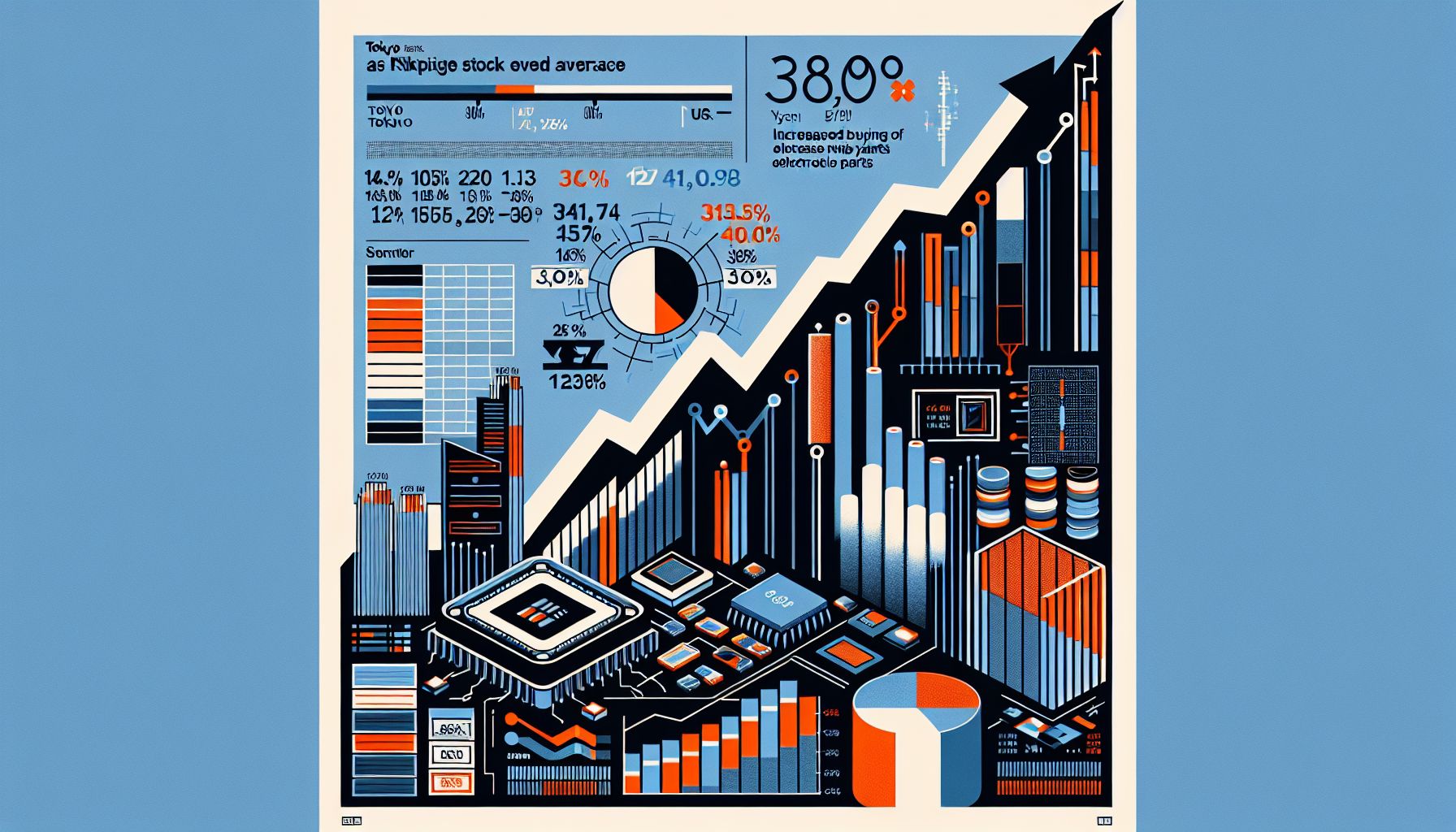

tokyo’s nikkei stock average jumped, reclaiming the 38,000 yen level. this surge follows the us and china agreeing to lower additional tariffs. investor confidence rose, driving increased buying of semiconductor and electronic components stocks. the us will reduce tariffs from 145% to 30%. china will reduce tariffs from 125% to 10%. the yen weakened to 148 against the dollar. analysts believe this marks a positive step for both economies, potentially easing global supply chain concerns.

market reaction

The tokyo stock exchange (tse) saw the nikkei stock average begin trading with a significant rise [1]. The nikkei started the day up 505.27 yen from the previous day, reaching 38,149.53 yen [1]. The upward momentum continued, exceeding an increase of 700 yen shortly after the opening bell [1]. This surge reflects a broader trend, with the tokyo stock price index (topix) also experiencing gains [2]. Semiconductor and electronic component stocks are leading the buying surge, propelled by improved investor sentiment [1][2].

tariffs and currency

The agreement involves substantial tariff reductions [8]. The united states will decrease its tariffs on chinese goods from 145% to 30% [2][8]. China will reduce its tariffs on u.s. goods from 125% to 10% [2][8]. Concurrently, the yen’s exchange rate weakened, reaching approximately 148 yen per dollar [2]. This yen depreciation is driven by a decrease in investor risk aversion, leading to reduced demand for the yen as a safe-haven currency and increased buying in automobile stocks like toyota [2].

expert opinions

Analysts view this agreement as a positive development [2][8]. Kenneth blue, a senior strategist at societe generale, notes the easing of tensions between the u.s. and china is favorable for risk assets, particularly u.s. assets and the u.s. economy [8]. zhang zhiwei, chief economist at pinpoint asset management in hong kong, stated the tariff reductions exceeded expectations and are beneficial for both economies and the global economy, alleviating concerns about damage to global supply chains [8]. However, zhiwei also noted that the tariff reduction is temporary for 90 days [8].

winners and losers

The easing of trade tensions has impacted various stocks [2]. Tokyo electron and fast retailing experienced increases [2]. Recruit holdings also saw gains [2]. Conversely, kddi, secom, and nitori holdings faced declines [2]. The initial market response suggests a sector-specific impact, influenced by the perceived benefits and challenges posed by the evolving trade landscape [alert! ‘further analysis needed to determine long-term effects on specific sectors’]. These shifts reflect the complex interplay of factors influencing investor decisions in response to the u.s.-china trade agreement.

Bronnen

- www.nikkei.com

- www.nikkei.com

- fx.minkabu.jp

- www.nri.com

- www.asahi.com

- bloomo.co.jp

- www.asahi.com

- www.arabnews.jp