takenaka's off-grid field: mobile offices for rent

Tokyo, Thursday, 17 April 2025.

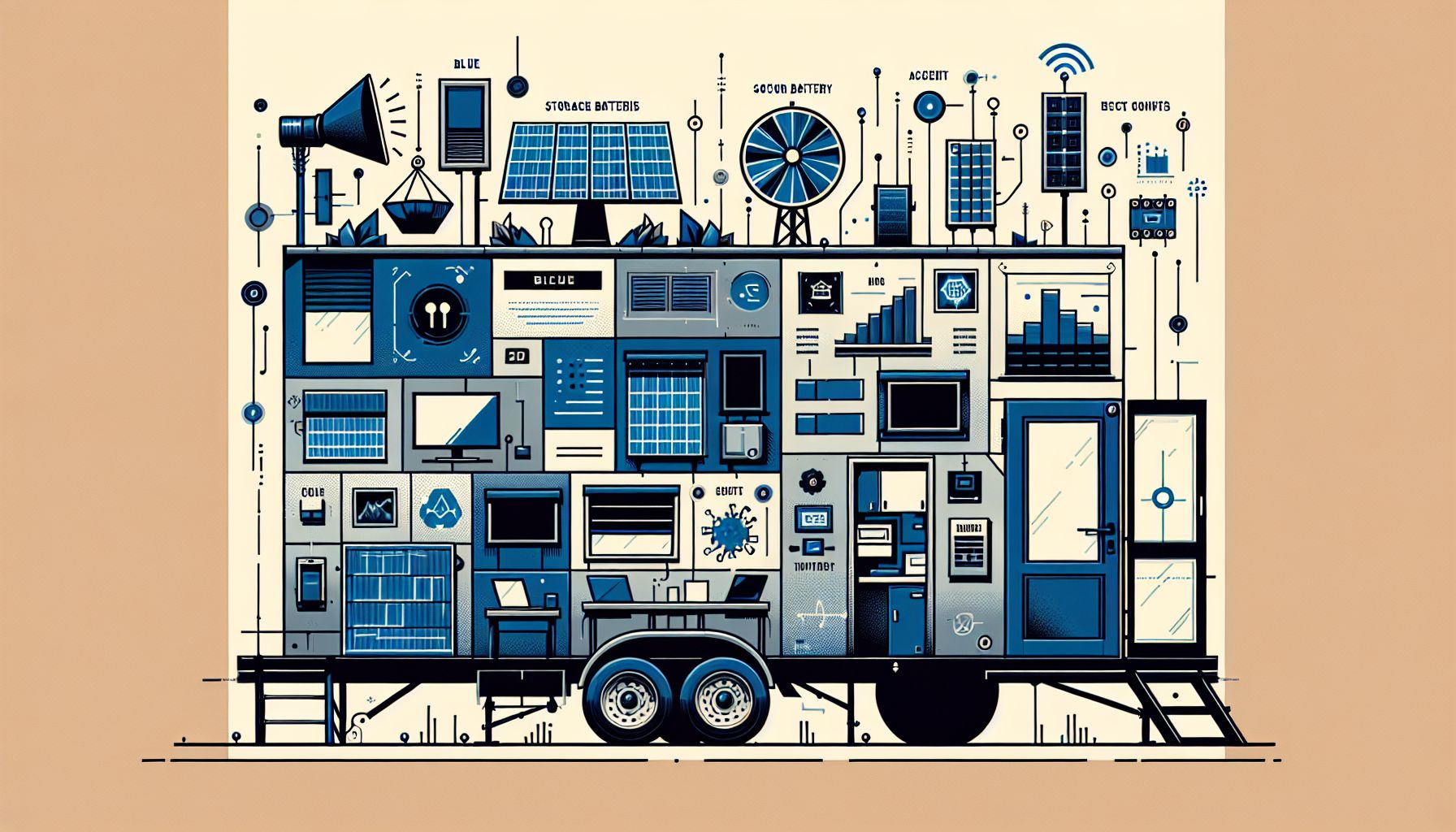

takenaka corporation is launching off-grid field, a rental service for mobile offices and stores. these trailer houses are equipped with solar panels, storage batteries, and satellite communication. starting at ¥300,000 per month, these units target heatstroke countermeasures, event support, and disaster response. the company plans to deploy 45 units within five years. these mobile units will provide on-demand infrastructure.

strategic move for takenaka

Takenaka Corporation’s launch of Off Grid Field signals a strategic diversification into the rental market for mobile infrastructure [1]. This move addresses growing needs for heatstroke countermeasures, event support, and disaster response solutions [1]. The company will rent trailer houses equipped with solar panels, storage batteries, and satellite communication [1]. These features allow for independent operation in various locations [1]. The rental cost is approximately ¥300,000 per month [1]. This initiative reflects Takenaka’s effort to capitalize on emerging market demands for flexible and sustainable solutions.

financial implications and market potential

With a capital of ¥60 million, Takenaka holds a 66.6% stake in Off Grid Field, while Croco Art Factory holds 33.4% [1]. This investment indicates Takenaka’s confidence in the venture’s potential [1]. The company aims to deploy 30 small houses for offices and 15 large houses for stores within five years [1]. This plan suggests a measured approach to market penetration and scalability [1]. Hiroki Naritaka, President of Off Grid Field, noted demand from event organizers seeking heatstroke prevention measures [1]. This highlights a specific market segment driving initial adoption.

investor outlook

Investors should consider Off Grid Field’s potential impact on Takenaka’s stock value. The creation of a new revenue stream through rentals could improve financial performance [GPT]. The focus on sustainable and mobile solutions aligns with current market trends [GPT]. Takenaka previously tested similar mobile stores with FamilyMart at the Osaka-Kansai Expo construction site in 2024 [1]. This prior experience could mitigate risks and improve operational efficiency [GPT]. However, investors should monitor the actual deployment and rental rates to assess the venture’s long-term profitability [alert! ‘need more data to assess profitability’].