Trump's tariff threat sends TSMC stock tumbling as chip sector braces for impact

Taipei, Tuesday, 26 November 2024.

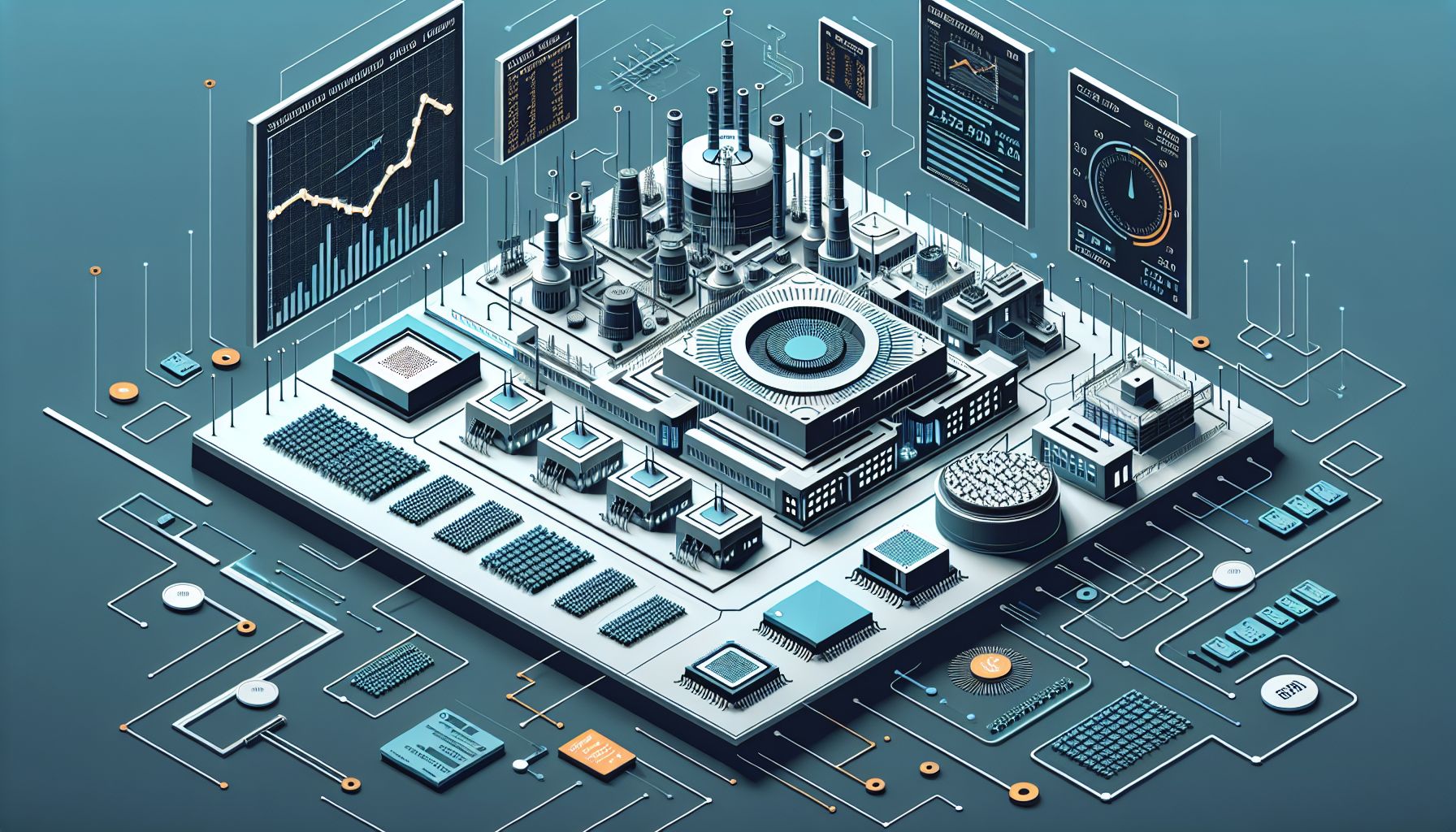

TSMC, the world’s largest semiconductor manufacturer, saw its stock drop by 1.94% after Donald Trump announced plans to impose new tariffs on China, Mexico, and Canada. The former president’s promise of a 10% tariff on Chinese imports and 25% on Mexican and Canadian goods rattled global markets. The news hit particularly hard in Taiwan, where TSMC’s shares fell to 1010 TWD, while its American Depositary Receipts dropped 2.6% to $185.08. The market reaction comes at a crucial time for TSMC, which is preparing to launch its groundbreaking 2-nanometer chip production facility. This development highlights growing concerns about the vulnerability of global semiconductor supply chains to geopolitical tensions.

impact on manufacturing capacity

TSMC’s strategic plans are facing disruption amid the tariff threats. The company is preparing to launch its new 2-nanometer chip production facility, a significant step in maintaining its leadership in semiconductor technology. However, the uncertainty caused by potential tariffs has forced TSMC to adjust its CoWoS (Chip on Wafer on Substrate) capacity plans. This adjustment reflects the broader challenges in the semiconductor industry, where geopolitical tensions are reshaping supply chains and manufacturing strategies[1][2].

geopolitical risks and market leadership

The tariff threat underscores the geopolitical risks that companies like TSMC face. TSMC, a key player in the global chip market, finds itself at the center of US-China trade tensions. The proposed tariffs could lead to increased production costs and supply chain disruptions. Despite these risks, industry leaders, such as former TSMC chairman Mark Liu, have expressed confidence in Taiwan’s chip industry’s resilience. Liu indicated that although the trade policies are challenging, they have not yet deterred TSMC’s strategic commitments[3][4].

market expert views

Market experts are closely watching TSMC’s response to the tariff threats. Analysts note that while the immediate stock drop reflects investor anxiety, the long-term impact will depend on how TSMC navigates the shifting landscape. The company has remained a pivotal supplier for major tech firms like Apple and AMD, which rely on its cutting-edge manufacturing capabilities. Nvidia, for instance, has already secured a significant portion of TSMC’s future CoWoS capacity, highlighting the company’s continued importance in the tech ecosystem[5].