china restricts exports of key minerals amid tech trade tensions

Beijing, Thursday, 5 December 2024.

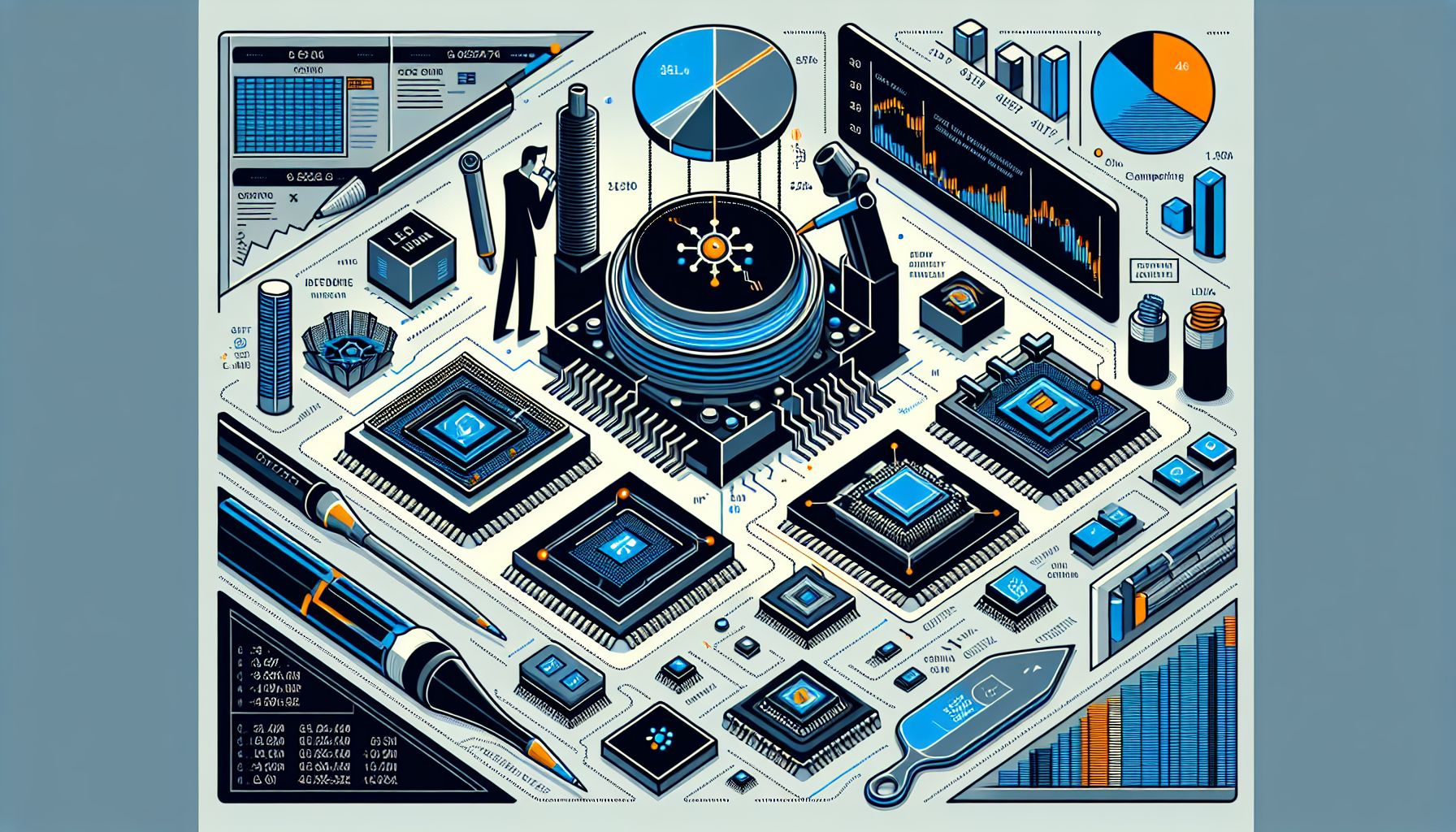

In a significant escalation of the ongoing tech trade conflict, China has imposed new export restrictions on crucial minerals like gallium, germanium, and antimony, effective December 3, 2024. These minerals are vital for semiconductor production, impacting major U.S. tech companies and potentially disrupting global supply chains. This move is a direct response to recent U.S. semiconductor trade restrictions, highlighting the intensifying tit-for-tat nature of U.S.-China trade relations. The U.S. relies heavily on China for these materials, with China producing 94% of the world’s gallium and 83% of its germanium. The ban could have significant implications for industries reliant on these elements, such as defense, consumer electronics, and telecommunications. This action comes just weeks before President-elect Donald Trump’s inauguration, raising concerns about a potential new phase in the trade war between the two economic giants.

Market impact and supply dominance

China’s strategic position in the mineral market is substantial, controlling 94% of global gallium and 83% of germanium production [5]. The impact is already visible in trade data, with antimony exports to the US plunging by 97% in October 2024 compared to September [5]. The price of antimony has more than doubled in 2024 to over $25,000 per tonne [2]. This market dominance gives China significant leverage, as the US currently obtains approximately 50% of its gallium and germanium supply directly from Chinese sources [2].

Industry response and supply chain disruption

The restrictions have prompted immediate industry reactions. The China Association of Automobile Manufacturers has expressed concerns about the stability of US chip supplies [5]. Expert Brady Wang notes that while these metals are critical for high-tech industries, their upstream position in the supply chain means immediate production impacts may be limited [5]. However, Chong Ja Ian from the National University of Singapore warns that these ‘back and forth curbs’ could trigger supply chain disruptions and inflationary pressures [5].

Political implications and future outlook

The timing of China’s export ban is particularly significant, coming just six weeks before Donald Trump’s inauguration [6]. The president-elect has already announced plans to impose a 60% tariff on Chinese goods upon taking office [2]. This escalation follows the US government’s December 2 announcement expanding restrictions on 140 companies, including Chinese firms Piotech and SiCarrier [5]. US National Security Adviser Jake Sullivan maintains these measures are necessary for national security [2].

Alternative supply strategies

The US is actively pursuing alternative supply sources. A promising development emerged in March 2024 with the discovery of high-grade gallium deposits in Montana [2]. The US Congress is considering measures to support domestic production and strengthen partnerships with allies [1]. These proposed initiatives include financing for US firms, expanding domestic stockpiles, and streamlining regulatory processes for mine development [1].