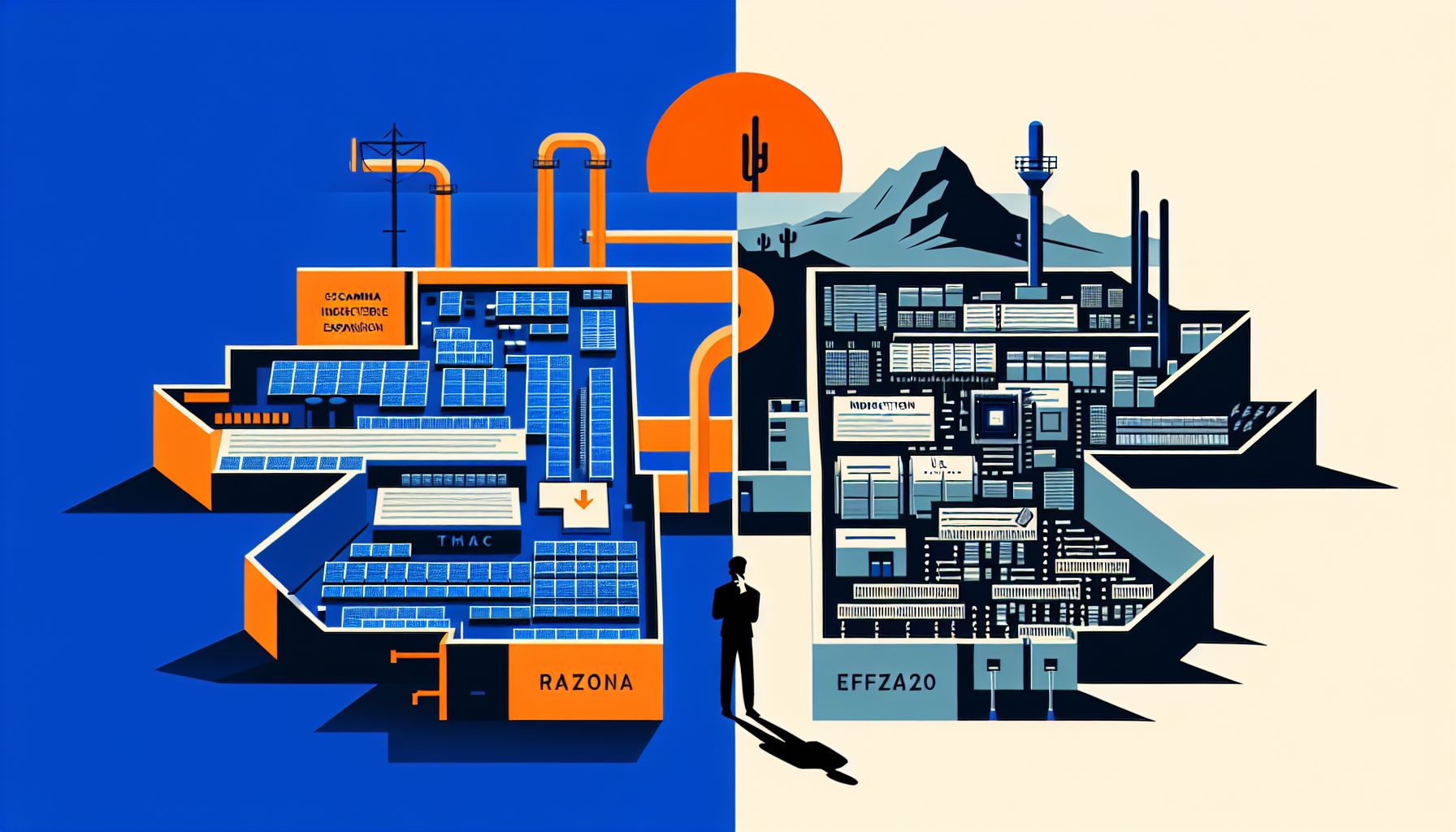

tsmc's expansion in the us hits roadblocks

Arizona, Monday, 20 January 2025.

tsmc is facing significant obstacles at its Arizona facility, impacting its advanced manufacturing plans. Geographic challenges and bureaucratic hurdles have emerged as major issues. These hurdles are not just slowing down production. They are also threatening tsmc’s expansion strategy in the United States, potentially affecting its competitive market position. The situation has raised questions about the viability of meeting projected production timelines. Both the geographic separation from Taiwan’s key resources and the intricate regulatory landscape in the U.S. contribute to these challenges. The company’s ability to implement cutting-edge technologies in its American plant is under scrutiny. This issue is critical for tsmc, as it plays a strategic role in the Biden administration’s goal to bolster domestic semiconductor production, aiming for 20% of global output by the end of the decade. Strategic solutions to these operational challenges remain undeveloped at this stage.

Production realities at Arizona facility

TSMC has commenced mass production of 4nm chips at its Fab 21 facility in Arizona during Q4 2024 [1][2]. However, the facility faces significant cost challenges. Higher depreciation expenses, smaller production scale, an incomplete local ecosystem, and the necessity to ship products to Asia for packaging all contribute to elevated manufacturing costs [2]. These factors have forced TSMC to charge higher prices for orders from the Arizona plant compared to its Taiwan facilities [2].

Investment and expansion plans

The company has committed substantial resources to its U.S. expansion, with total investments reaching $65 billion for three fab modules in Arizona [3]. This investment is supported by $6.6 billion in government grants and up to $5 billion in loan guarantees under the CHIPS and Science Act [3]. Despite these incentives, TSMC Chairman Mark Liu has indicated that geographic distance from Taiwan’s research centers and complex U.S. bureaucratic procedures may prevent the Arizona facility from matching Taiwan’s capabilities [4].

Strategic timeline and technological progression

TSMC has outlined a phased development approach for its Arizona operations. The first phase is now producing 4nm and 5nm chips, while the second phase is scheduled to introduce 3nm technology by 2028 [3]. The third phase, planned for the end of the decade, aims to manufacture 2nm and 1.6nm node chips with backside power delivery [3]. This expansion aligns with the U.S. government’s objective to produce 20% of global advanced logic chips by 2030 [3].