Laatste nieuws in general

rohm and infineon team up to standardize sic power semiconductor packaging

Munich, Thursday, 25 September 2025.

rohm and infineon are joining forces to standardize silicon carbide (sic) power semiconductor packages. this will allow customers to source compatible products from both companies. this collaboration addresses supply chain diversification and geopolitical risks. interchangeable specifications will ensure greater flexibility and security. infineon holds a 20% global market share in power semiconductors. denso, a rohm collaborator, also invests in infineon. this strategic move provides customers with more options in a volatile semiconductor market where three chinese companies are now top players.

yen dips to 148: tokyo stock exchange navigates choppy waters

Tokyo, Thursday, 25 September 2025.

the tokyo stock exchange faced a day of seesaw trading on september 25, 2025. the nikkei average oscillated. it mirrored the previous day’s close amid a confluence of factors. a weakening yen, now at 148 against the dollar, offered a tailwind. profit-taking curtailed gains. us economic indicators and rising long-term interest rates added complexity. while some stocks like sony group and bandai namco holdings saw gains, others including advantest and softbank group faced selling pressure. the tokyo stock price index (topix) continued its rise, hitting new highs.

EUV Tech bets big on asian semiconductor growth with singapore expansion

Singapore, Wednesday, 24 September 2025.

EUV Tech, a leading provider of extreme ultraviolet (EUV) metrology solutions, has expanded its global presence. The company opened its first international office in Singapore. This move highlights Singapore’s increasing significance in the semiconductor supply chain. The expansion will allow EUV Tech to better support its clients in Asia. The company’s tools are already used in every major semiconductor fabrication plant (fab) worldwide. The new Singapore office will enhance service capabilities and response times for customers in the region. This impacts key players like TSMC and ASML.

Nikkei hits new high: is fiscal policy the key?

tokyo, Wednesday, 24 September 2025.

The Tokyo Stock Exchange closed higher for the second day. The Nikkei average rose 0.30% to 45,630.31 yen. This surge reflects growing anticipation for fiscal expansion under the upcoming administration. SoftBank Group’s planned large-scale investments in US artificial intelligence further boosted the market. One company alone pushed the Nikkei up more than 200 points. Despite initial selling pressure from US stock declines, strategic buying drove the market to new heights. The question remains if these gains will continue.

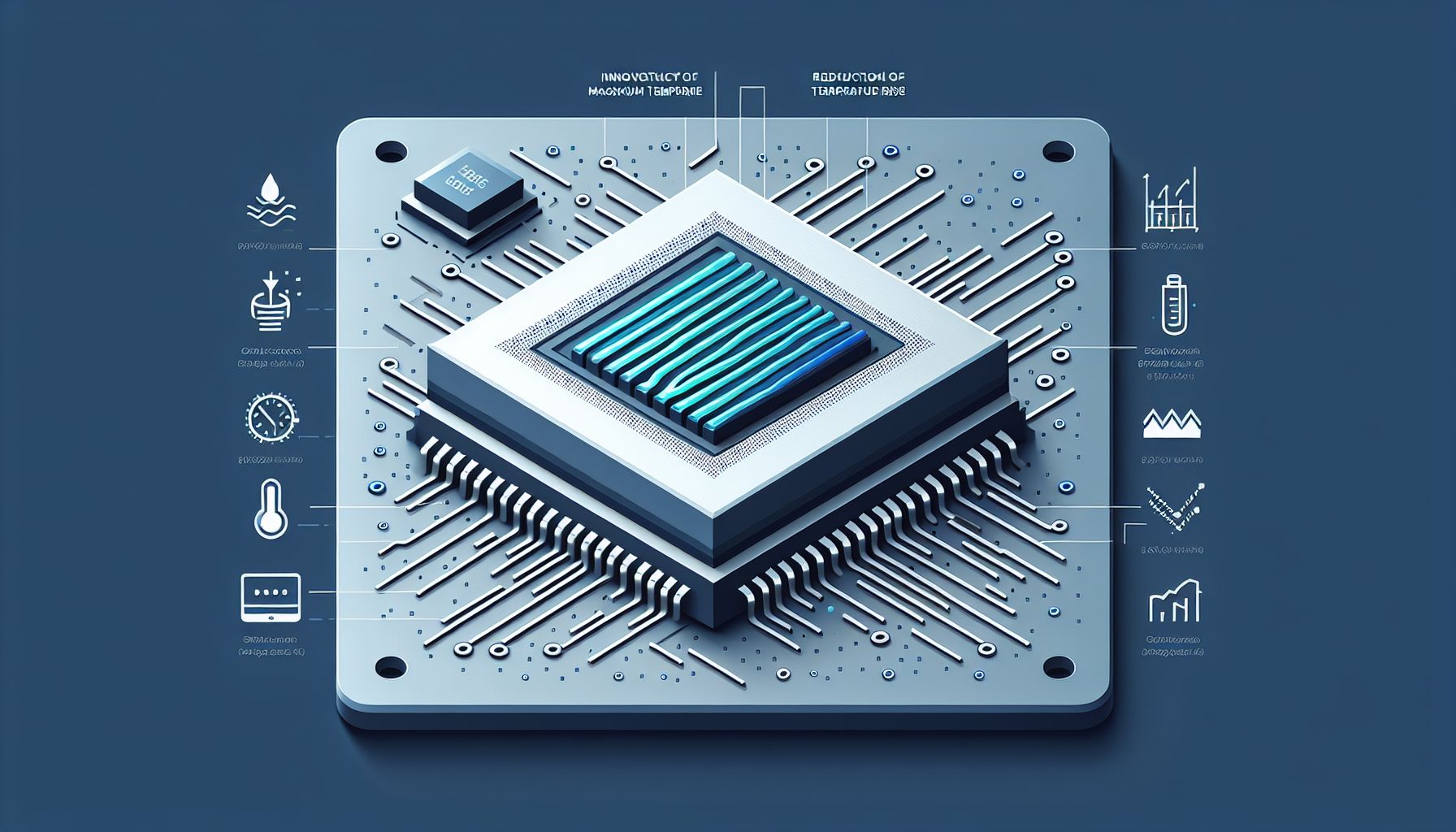

Microsoft's microfluidic cooling slashes gpu temps by 65%

Redmond, Tuesday, 23 September 2025.

As AI chips generate more heat, Microsoft has innovated a microfluidic cooling system. This system etches channels directly onto the silicon, allowing liquid coolant to flow. Lab tests demonstrate a 65% reduction in maximum temperature rise within a GPU. The new system can remove heat three times better than traditional cold plates. This breakthrough enables denser, more powerful designs and could revolutionize data center architecture, enabling 3D chips and increasing server density, according to Microsoft.

Global Cloud Race Heats Up: $300 Billion on the Line

Beijing, Tuesday, 23 September 2025.

Global cloud infrastructure spending is set to surge past $300 billion next year. This is driven by cloud giants and strategic initiatives in both China and the US. China’s ‘East-Data-West-Calculation’ and the US CHIPS Act are major catalysts. These are boosting data center infrastructure and semiconductor manufacturing. Tektronix unveils new testing solutions. These include oscilloscopes with record-breaking data transfer speeds. Tektronix plans to launch a 200V high-performance SMU module in early 2026.

chip industry sounds alarm over h1-b visa changes

Washington, Tuesday, 23 September 2025.

semi, representing the electronics design and manufacturing supply chain, is pushing back on recent h1-b visa policy shifts. the group insists access to global talent is vital. this access is needed to maintain america’s competitive edge in the semiconductor industry. with the u.s. aiming to ramp up domestic manufacturing, semi stresses the need for policies. these policies will attract and retain skilled workers. the industry body’s statement comes amid concerns that new restrictions could hinder innovation and growth, potentially costing companies $100,000 per visa.

china's chip independence drive: betting on duv amid euv access hurdles

Beijing, Tuesday, 23 September 2025.

facing restrictions on euv lithography, china is aggressively pursuing duv technology to achieve semiconductor self-sufficiency. this involves significant investment in domestic duv manufacturing and advanced multi-patterning techniques. smic is currently testing duv lithography machines that are designed to produce 7nm chips. while asml’s ceo estimates china is 10 to 15 years behind, this strategy aims to mitigate geopolitical risks and reshape the global chip landscape, potentially impacting asml’s future revenues.

micron's earnings: a key indicator for nvidia and tsmc investors

Chicago, Monday, 22 September 2025.

zacks analyst blog highlights micron’s upcoming earnings report, which could significantly impact nvidia, tsmc, and western digital. micron’s fourth-quarter fiscal 2025 results are expected on september 23, 2025. the consensus estimate for micron’s top line revenue is $11.1 billion, a 43.3% year-over-year increase. the consensus mark for micron’s bottom line has been revised upward to $2.87 per share, a 143.2% improvement year-over-year. investors are keenly watching micron’s performance as a bellwether for the semiconductor industry.

nikkei soars to unprecedented heights: what's driving the tokyo surge?

tokyo, Monday, 22 September 2025.

the tokyo stock exchange is making headlines. The nikkei average hit a record high of 45,493.66 yen. Semiconductor stocks are leading the charge. Foreign investment is pouring in. Anticipation of us interest rate cuts and a robust us economy are key factors. The bank of japan’s etf sale decision may be a catalyst for corporate reform. Even samsung electronics in south korea is benefiting from nvidia’s recognition. What does this mean for global markets?