japan's rapidus leads with cutting-edge euv installation

Japan, Friday, 20 December 2024.

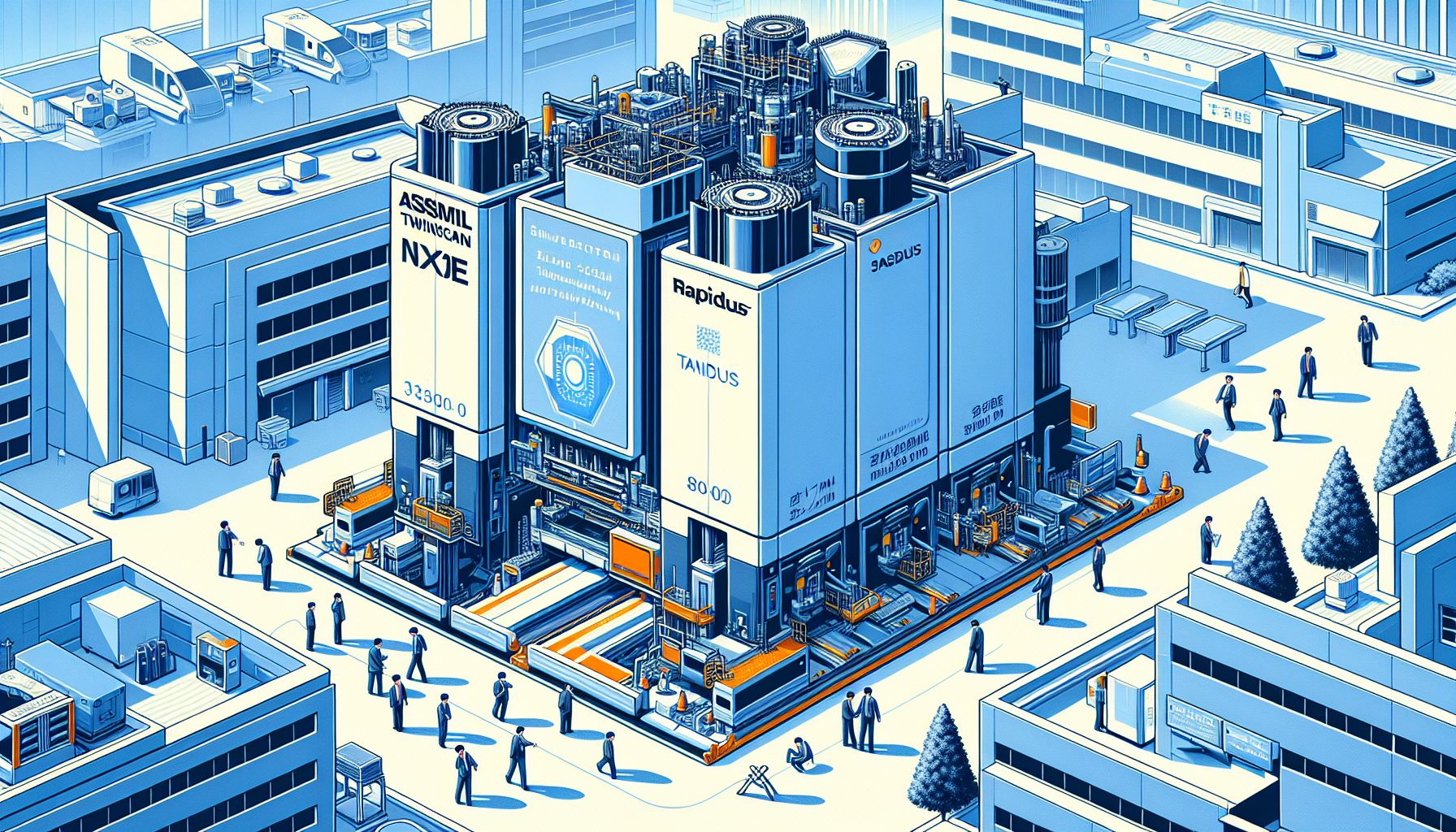

Rapidus has made a significant leap in Japan’s semiconductor industry by becoming the first Japanese company to install ASML’s advanced EUV lithography machines. This move sets the stage for producing 2nm chips, with prototype production expected in 2025 and mass production by 2027. The installation of the ASML TWINSCAN NXE:3800E at Rapidus’s IIM-1 facility in Hokkaido marks a milestone, as EUV technology is crucial for manufacturing the most advanced chips. This development positions Rapidus alongside global leaders like TSMC and Samsung in the race for cutting-edge semiconductor technology. The installation involves a complex process due to the machinery’s massive size and weight, underscoring the technological advancements required to reduce defect densities and improve yields. With this strategic move, Rapidus aims to revitalize Japan’s presence in the global semiconductor market, once a dominant force in the 1980s.

Market significance for ASML

ASML maintains its position as the exclusive global supplier of EUV lithography systems [3][5]. Each system commands a premium price of over $180 million [5]. The company’s market dominance is evident in its limited distribution, with only 42 units shipped worldwide last year [5]. The installation at Rapidus expands ASML’s elite customer base beyond existing clients TSMC, Samsung Electronics, and Intel [5].

Technical specifications and installation process

The TWINSCAN NXE:3800E, weighing 71 tonnes and standing 3.4 meters tall, requires a four-stage assembly process [1][5]. This particular model is specifically designed to support high-volume manufacturing of 2nm logic nodes [3]. The installation began on December 17, 2024, at the IIM-1 facility in Chitose, Hokkaido [2], with completion expected by December’s end [1].

Strategic implications for Japan

This installation represents a crucial step in Japan’s semiconductor revival. The country’s market share has drastically declined since the 1980s, when it controlled over 50% of the global semiconductor market [5]. The $32 billion IIM-1 facility [1] demonstrates Japan’s commitment to regaining its position. Rapidus’s partnership with IBM for 2nm process technology development [1] aims to close the gap with industry leaders, though they will trail TSMC’s 2025 production timeline by approximately two years [1].